This put up is a collaboration with Nick Maggiulli from Of {Dollars} and Knowledge.

I learn Nick’s ebook, Simply Hold Shopping for, and the factor I cherished most was how he backed up all his arguments with information.

I used to be chatting to him on Twitter about why I loved his ebook, and he mentioned, “In the event you ever wish to collaborate on one thing (or need me to run a simulation of one thing for you), let me know.”

I had a subject I believed can be good to collaborate on, and this text is the outcome.

I’ve all the time had an issue with the 4% rule for early retirement.

It’s not as a result of it’s unhealthy or flawed.

It’s as a result of it’s not for early retirement.

The 4% Rule: Why It’s Not Excellent for Early Retirement

My largest subject is that it doesn’t account for the pliability of most early-retirees.

It’s for normal retirement, and “conventional” retirees of their 70s or 80s aren’t prone to have as a lot way of life or spending flexibility as somebody of their 30s or 40s.

By the point somebody has reached the tip of their profession of their 70s, it’s probably they:

- Have settled on a stage of spending they need (or want) to take care of

- Haven’t any want (or capacity) to get one other job, if the shit hits the fan

- Are sure to a specific space (and even home)

- Have a excessive share of their spending going in the direction of important bills, like meals and healthcare

- Are extra delicate to inflation (resulting from a excessive share of important bills)

Evaluate that to somebody of their 30s or 40s who retires early and has:

- A extra versatile way of life with much less mounted bills

- The power to select up part-time or full-time work, if mandatory

- The liberty and/or want to dwell in stunning however low-cost locations, like Southeast Asia or South America, to cut back bills with out lowering their high quality of life

- A excessive share of their spending going in the direction of discretionary bills (e.g. journey, eating, drinks with pals, and so on.)

The 4% rule doesn’t account for any of that flexibility.

It assumes you’re going to spend 4% of your portfolio’s worth in your first 12 months of retirement, after which enhance that spending with inflation yearly after.

Talking of inflation…

What About Fastened Prices?

In a latest Cash with Katie episode with the man who created the 4% rule, William Bengen, Katie brings up the purpose that 4% is already conservative due to the way in which it treats inflation.

It assumes you’re going to inflation regulate ALL of your spending yearly, whether or not inflation impacts each expense or not.

When you’ve got a 30-year-fixed mortgage, for instance, your largest expense might not be impacted by inflation in any respect!

Different Causes the 4% Rule is Conservative

I like to recommend you take heed to your entire Cash With Katie interview, however listed below are a couple of different causes from that episode that 4% could also be overly conservative:

- The 4% rule was initially the 4.15% rule, but it surely was rounded down by mainstream media as a result of 4% was simpler to say/bear in mind

- The 4.15% rule is now truly the 4.8% rule, based mostly on Invoice Bengen’s up to date evaluation (which incorporates further asset courses)

However the Cash Has to Final Longer?

So the 4% rule is conservative for a 30-year retirement, however don’t we have to decide a decrease withdrawal fee for a 40+ 12 months early retirement?

Sure, however not as little as you might suppose.

We explored this subject in depth throughout my interview with Michael Kitces (nonetheless one among my most-popular episodes of all time).

If you wish to add 10 years to an ordinary retirement, you need to lower your preliminary withdrawal fee by ~0.6%.

And surprisingly, a portfolio that survives for 40 years is prone to survive for 50 or 60+ years (see my put up on Sequence of Returns Threat to be taught why).

Are We Again The place We Began?

So if the 4% rule is definitely the 4.8% rule, however we have to lower that by ~0.6%, aren’t we again to roughly the place we began (i.e. 4%)?

Sure, however we haven’t accounted for early-retirement flexibility but!

And that’s what this complete put up is about.

Incorporating Flexibility Into Your Withdrawal Technique

Earlier than Nick began crunching the numbers, we went forwards and backwards to determine one of the best ways to issue flexibility into the withdrawal fee, and right here’s what we got here up with…

Discretionary Spending Share

First, work out the proportion of your spending that goes in the direction of discretionary bills.

Discretionary bills are any bills you’re feeling you could possibly do with out, if mandatory.

Calculate New Withdrawal Fee

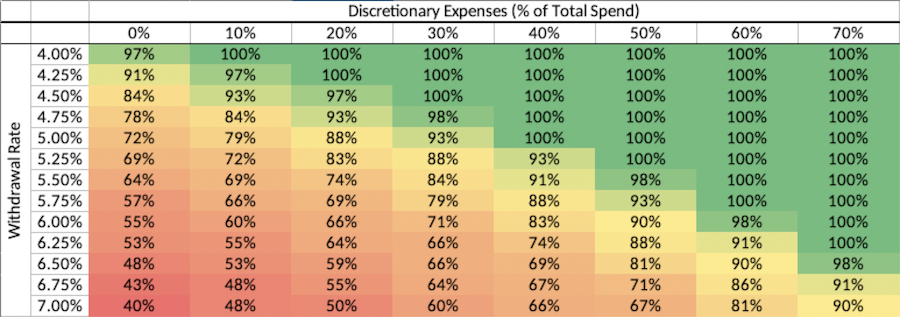

After getting your discretionary spending share, discover it on the next desk after which decide a snug success fee in that column to seek out your withdrawal fee (the desk assumes an 80/20 inventory/bond portfolio allocation).

Or, when you’ve got a FI Laboratory account, you should utilize the calculator I created to compute your withdrawal fee utilizing this methodology.

In the event you don’t have a FI Laboratory account, you possibly can get one totally free right here!

Withdrawal Guidelines

Now, you need to have a withdrawal fee that’s greater than 4%, so you could possibly retire sooner (as a result of the next withdrawal fee means you’ll want to avoid wasting up much less cash to cowl your annual bills)!

There’s no free lunch although (you possibly can’t simply withdraw extra yearly and anticipate your portfolio to final so long as it might have with the 4% rule), so there are some easy guidelines it’s important to observe for this technique to work:

- Whereas in a bear market (>20% off of highs), withdraw $0 for discretionary spending

- When the market is in a correction (>10% under highs), withdraw 50% of your discretionary finances

- All different occasions, withdraw your complete discretionary finances

Let’s see how this might work with an instance…

Discretionary Withdrawal Fee Instance Situation

Let’s say a retiree has $1M in an 80/20 portfolio.

Utilizing the 4% rule, that may enable for $40,000 in spending in 12 months one, adjusting for inflation every year thereafter. With this portfolio and withdrawal technique, there’s a 96.55% probability of success (throughout all 40 12 months durations from 1926-2022).

However can we hold the identical likelihood of success whereas withdrawing extra with our new withdrawal methodology?

Sure, if the retiree follows the foundations…

If they’ve 50% of their spending as discretionary spending, they will withdraw 5.5% (as a substitute of 4%) and nonetheless have a 98.28% likelihood of success (throughout all 40 12 months durations from 1926-2022)!

Utilizing our $1M portfolio for instance, in 12 months one they might withdraw $27,500 as important spending (half of the 5.5%) after which withdraw:

- $27,500 as discretionary (if the market is <10% from its highs)

- $13,750 as discretionary (if the market is >10% off its highs, however <20% off its highs)

- $0 as discretionary (if the market is >20% off its highs)

Whereas the important spending adjusts upwards with inflation yearly, the discretionary spending doesn’t transfer with inflation (analysis exhibits that retirement spending tends to lower over time, so this gradual lower in actual spending energy must be manageable, whereas additionally making certain important bills are all the time lined).

So in 12 months two, after a 12 months of 5% inflation, this particular person would withdraw $28,875 for his or her important bills after which both $27,500, $13,750, or $0 for his or her discretionary bills (relying on the previous 12 months’s market efficiency).

Utilizing this methodology, you’d have roughly the identical likelihood of success over 40 years and, in most years (i.e. good years), you could possibly withdraw extra money!

Or, you could possibly use this methodology to retire years earlier…

On this instance, the particular person would want to attend till they hit $1 million to retire to cowl their $40k of annual bills, utilizing the 4% rule.

In the event that they use this new methodology as a substitute although, with a 5.5% withdrawal fee, they’d solely want to avoid wasting up $727,273 to withdraw the identical $40k for bills (though, they’d want to chop again on their discretionary spending in down years).

Different Advantages of this Technique

This methodology means that you can spend extra and/or retire earlier, which is nice, but it surely additionally comes with further advantages…

Buffett’s quote about inheritance applies properly to early retirement – “A really wealthy particular person ought to go away his youngsters wealthy sufficient to do something however not sufficient to do nothing.”

I’ve seen a bunch of early retirees (myself included) race to the FI end line, solely to be left disoriented when confronted with the truth that cash is not a motivating issue of their lives (and subsequently, they may do “nothing”).

Having this discretionary withdrawal technique appears to resolve loads of the issues I see with full FI:

- It encourages you to deal with lowering your mounted prices (i.e. the bills that actually matter) however allows you to chill out together with your enjoyable/discretionary spending.

- In down years, you’re pressured to reevaluate your discretionary spending (so that you don’t simply hold mindlessly spending on issues that you could be not present worth anymore)

- It provides you a pot of cash particularly for discretionary spending, so that you’ll hopefully be extra prone to spend on enjoyable issues (relatively than simply hold saving and saving, like I did).

- If you attain your quantity, you might have sufficient to do “something” however not sufficient to do “nothing” (until you’re proud of $0 of discretionary spending throughout bear markets).

- Cash remains to be a motivating think about your life, as a result of you might wish to have some earnings coming in throughout down years

- Since your spending/way of life is altering year-to-year, you’ll hopefully respect issues extra (relatively than simply get right into a routine of spending/doing the identical issues)

What if my porfolio’s efficiency differs from the market?

Simply because the general inventory market is tanking, that doesn’t imply my portfolio is down 20%…shouldn’t the discretionary finances be calculated based mostly on what my very own portfolio is doing?

We considered this, however we favored the simplicity of utilizing the market as a information. All of the monetary headlines will likely be screaming, “Bear market!!” when the general market is down 20%, however no one cares what your portfolio is doing.

Plus, the time to tighten your belt and be extra cautious is when there’s worry within the streets. When the general market is in an enormous correction, the true economic system may begin to falter. That will make it tougher to seek out work, if mandatory. So it is smart to tighten your finances when the general economic system is on shaky floor.

What if I don’t wish to in the reduction of a lot throughout down years?

That’s the great thing about the technique…you get to resolve your discretionary share.

So in case your mounted/important bills are 50% of your finances, however you recognize you need at the least 15% to spend on discretionary spending to take pleasure in life (even in down years), then simply deal with 65% of your finances as important and say that 35% is discretionary. You’ll should work/save longer, but when that leads to an early retirement that you just take pleasure in, it’s value it.

What do you suppose?

There appear to be loads of advantages to pondering otherwise about your important and discretionary bills on the subject of early retirement, however what do you suppose?

Do you want this methodology, or is it too sophisticated/dangerous? Are there some other advantages/downsides I didn’t point out? Let me know within the feedback under!

Simply Hold Shopping for

As soon as once more, enormous due to Nick for taking the time to run all these simulations!

I most likely wouldn’t have gotten round to writing about this subject, had it not been for Nick’s sort supply. So in case you favored this put up, remember to thank him by testing his glorious weblog (Of {Dollars} and Knowledge) and ebook (Simply Hold Shopping for)!