Welcome again to a different month-to-month replace from Root of Good! After a two week cruise exploring the Baltic Capitals in Europe, we’ll have nearly an entire month in Raleigh earlier than our subsequent large journey.

Throughout September, we spent the primary couple of weeks prepping for our cruise. It took quite a lot of time to analysis the eight completely different cities we visited across the Baltic sea. We visited Oslo in Norway, Aarhus and Copenhagen in Denmark, Stockholm in Sweden, Kiel and Rostock in Germany, Tallinn in Estonia, and Helsinki in Finland.

As at all times, the go to to every port was method too brief however what an enchanting journey it was! We visited 5 new-to-us nations. Every day, we have been in a position to maximize our restricted time to discover as a lot as attainable. The truth that our floating lodge adopted us from nation to nation made the rapid-fire journey a lot smoother.

On to our monetary progress. September was one other nice month for our funds. Our web price elevated by $67,000 to finish the month at $3,827,000. Our September earnings of $12,046 was far more than sufficient to cowl our spending of $2,694 for the month.

Let’s bounce into the small print from final month.

Earnings

Funding earnings totaled $10,468 final month. Our fairness index funds and ETFs pay dividends quarterly on the finish of March, June, September, and December. Consequently, we had a bigger than regular quantity of funding earnings paid in September. Right here’s extra on our dividend investments.

Weblog earnings totaled $354 for final month. This represents barely beneath common weblog earnings. My promoting income suffered since I skipped posting one month in the course of the summertime. Since advertiser funds lag a couple of months, I’m simply now seeing the impression.

My early retirement way of life consulting earnings (“consulting”) was $220 throughout final month. That represents two hours of consulting. Instances are nonetheless gradual however I’ve obtained a number of inquiries these days that I’m ready to listen to again about. In the event you attain out to me and by no means hear again, it may be as a result of your e-mail is obstructing my response. Depart me a touch upon the consulting web page and I’ll attempt to get in contact with you another method.

Tradeline gross sales earnings totaled $700 throughout final month. I ramped up my tradeline gross sales a couple of years in the past and mentioned it in a bit extra element in my October 2020 month-to-month put up and in my July 2021 month-to-month put up. Throughout 2024 I revamped $6,000 in trade for lending out my stellar credit score historical past from half a dozen bank cards. 2025 is on the trail to exceed the $6,000 mark.

My “deposit earnings” totaled $98. Of the whole deposit earnings, $26 got here from money again and incentive bonuses from the Rakuten.com and Mrrebates.com on-line buying portals (a few of which was earned from you readers signing up by these hyperlinks).

In the event you join Rakuten by this hyperlink and make a qualifying $30 buy by Rakuten, you’ll get a $30 enroll bonus.

The remaining $72 in deposit earnings got here from a pair of Fb class motion lawsuit settlement checks. Fb grievously injured our rights in some minor method that I can not recall however the $72 actually goes a protracted method to salve the injuries.

My financial institution and bank card bonuses totaled $205 final month. This bonus cash got here from the Chase Sapphire Reserve Pay Your self Again characteristic the place I reimburse myself for grocery purchases paid for with my Sapphire Reserve card.

In the event you’re inquisitive about monitoring your earnings and bills like I do, then take a look at Empower Private Dashboard, previously generally known as Private Capital (it’s free!). All of our financial savings and spending accounts (together with checking, cash market, and greater than half a dozen bank cards) are all linked and up to date in actual time by Empower Private Dashboard. We now have accounts all over, and Empower Private Dashboard makes it very easy to test on every part at one time.

Empower Private Dashboard can be a stable device for funding administration. Conserving monitor of our total funding portfolio takes two clicks. In the event you haven’t signed up for the free Empower Private Dashboard service, test it out at the moment (evaluate right here).

Monitoring spending was one of many important steps I took that allowed me to retire at 33. And it’s now simpler than ever with Empower Private Dashboard.

Pics from our port go to to Stockholm, Sweden:

Bills

Now let’s check out September bills:

In whole, we spent $2,694 final month which is about $600 lower than our commonly budgeted $3,333 per 30 days (or $40,000 per 12 months). Groceries and automotive have been the highest two spending classes from final month.

Detailed breakdown of spending:

Groceries – $783:

We have been on the town many of the month of September and spent a fairly peculiar sum of money on groceries. I haven’t seen a ton of inflation for meals these days, apart from beef costs.

Automotive – $658:

The annual inspection, automotive registration, and property taxes have been due for our Hyundai Accent. These price $20 for the inspection (with a $10 off coupon!) and $159 for the registration plus property taxes.

The remaining $479 of automotive prices got here from a set of 4 new tires for our Toyota Sienna minivan. In a departure from my regular fastidiously contemplated spending, I made a decision to randomly test the Low cost Tires web site for pricing for a set of 4 new tires and noticed that they’d a Labor Day sale occurring. That sale, stacked with some producer reductions, let me get a set of 4 tires put in, together with all of the taxes and environmental charges for a mere $479. These have been mid-grade Pirelli model tires however solely price about 10% greater than absolutely the least expensive tires on sale.

The final couple of occasions I introduced my van in for an oil change or tire rotation, the auto store would point out how the tires have been fairly worn and wanted alternative quickly. I didn’t see it personally, however trusted their experience (yeah, I do know they’re promoting me stuff!). The previous tires have been 8 years previous as properly, and the tire store claims tires are “expired” at 6 years of age as a result of potential for dry rot. I do know polymers break down over time and the method will be accelerated by UV publicity from the solar.

It’s safer to go forward and change the tires now as an alternative of ready for a blow out. We simply acquired again from a 600 mile highway journey, and having model new tires added quite a lot of peace of thoughts once I was barreling down curvy mountain roads with my household within the van. We now have loads of cash so I spent the $479 for brand spanking new tires as preventive upkeep.

Taxes – $400:

Our quarterly estimated taxes for the state of North Carolina got here due in September. I paid $400 in taxes and an $8 comfort charge to make use of my bank card for cost. The $8 bank card charge is included within the “journey” expense class.

Journey – $317:

Of the journey bills, $8 got here from the comfort charge simply talked about.

One other $176 coated our incidental bills throughout September for the 12 days we have been touring in Europe. A bunch of Uber/Lyft rides plus quite a lot of native transit tickets or practice tickets. We additionally paid about $50 for admission to the Royal Palace in Stockholm, Sweden.

We additionally spent $98 for 4 rental vehicles in Hawaii that we’ll decide up on our February cruise to the islands. I had 4 coupons from Chase Journey portal that coated $50 for every rental automotive. We ended up reserving $298 price of rental vehicles for $98 out of pocket. That seems like a fairly whole lot since we didn’t have a lot alternative as to the date or pickup location since we’ll be on a cruise with a predetermined itinerary.

The remaining $51 in charges coated the seat choice on our spherical journey nonstop flights to London within the spring of 2026. We just like the row of two seats close to the again of the aircraft, and so they have been nonetheless obtainable since we booked the flights very far forward of time. For $25 every method, it’s a steal to not have to take a seat subsequent to anybody for the seven hour flight. It’s nearly like enterprise class however a couple of thousand {dollars} cheaper! The flights themselves have been booked with Chase Final Rewards factors at a price of 38,700 factors per ticket to cowl the $580 money worth.

Pics from our port go to to Oslo, Norway:

Get free journey like us

In case you are inquisitive about getting free journey out of your bank card like I do, take into account the Chase Ink enterprise playing cards (my referral hyperlink). Proper now, the Chase Ink playing cards presents an above common $900 price of Chase Final Rewards factors that may be redeemed immediately for $900 in money (or much more for journey!).

Chase is fairly liberal in the case of “what’s a enterprise”. In the event you promote stuff on eBay or Craigslist or do some odd jobs often then you’ve got a enterprise and will get a bank card as a “sole proprietor”.

I exploit the 90,000 Chase Final Rewards factors by transferring them to my Chase Sapphire Reserve card (additionally providing a 60,000 level enroll bonus proper now). With the Sapphire Reserve card, I can get 1.5x the factors worth by reserving cruises, flights, lodges, or rental vehicles by their journey portal. For instance, I used 165,000 Chase Final Reward factors to pay for the $2,475 in taxes, charges, and gratuities on two of my cruises.

Or I can switch these Final rewards factors to over a dozen journey companions’ airline/lodge packages like United, Southwest, or Hyatt. For instance, I transferred 6,500 Final Rewards factors to Hyatt and used them to guide a $300/evening room that sleeps 5 in the course of the peak season within the Virginia mountains.

One other glorious alternative is the 120,000 level supply for the Chase Southwest Efficiency Enterprise card. These are sufficient factors for half a dozen spherical journey flights within the USA should you store fastidiously. This one card enroll bonus will generate sufficient factors to qualify for the Companion Move in order that all your Southwest flights are primarily purchase one, get one free.

Pics from our port go to to Aarhus, Denmark:

Healthcare/Medical/Dental – $232:

Our 2025 medical insurance is free due to very beneficiant Inexpensive Care Act subsidies that we obtain as a result of our low ~$51,000 per 12 months Adjusted Gross Earnings.

Our 2025 dental insurance coverage plan usually prices $32 in premiums per 30 days. We picked a plan from Truassure by the healthcare.gov trade. The dental insurance coverage does a superb job of protecting most of our routine cleanings, exams, and x-rays plus most of the price of primary procedures like fillings.

Mrs. Root of Good’s dental insurance coverage was $37 whole for 2 months. The August dental insurance coverage invoice posted late and ended up including to September’s dental bills. I already pay as you go my dental insurance coverage for the rest of 2025.

The opposite $195 in medical/dental bills have been the copays and deductible for some dental workplace visits and fillings.

Utilities – $158:

We spent $141 on our water/sewer/trash invoice final month.

No electrical invoice in September as a result of I paid it in October. Subsequent month I’ll in all probability pay two months of electrical payments.

The pure fuel invoice for final month totaled $17. Most of that’s the month-to-month connection cost. Only a few {dollars} for the precise fuel consumed by the water heater. This invoice will quickly improve as the times get colder and we have to crank up the warmth.

Gasoline – $56:

A tank of fuel for our Hyundai Accent and a half tank of fuel for our minivan. Going ahead, our youngsters have taken on the accountability of paying for many fuel purchases since they put probably the most miles on the vehicles with their ~400 miles per 30 days (per particular person) commute to work. I’ll nonetheless refill the vehicles often to cowl my “share” of the driving (and I’m fairly beneficiant about topping them off in fact!).

Eating places – $41:

Of the whole restaurant spending, $39 of it coated takeout from a restaurant for the household.

As well as, I used the $5 Doordash credit score from my Chase Sapphire Reserve card at Taco Bell and paid $2 additional to improve to a combo meal.

Cable/Satellite tv for pc/Web – $25:

We pay $25 per 30 days for a neighborhood diminished fee package deal as a result of having a decrease earnings and having children. 50 mbit/s obtain, 10 mbit/s add.

Training – $19:

A $19 charge to take the PSAT in eighth grade. This can be a standardized take a look at that ought to be reimbursable from our son’s 529 account underneath the brand new 2025 529 guidelines.

Residence Upkeep – $8:

The thermal cutoff fuse for our dryer died throughout September. I’ve changed this earlier than a few decade in the past so I used to be vaguely accustomed to the method. I additionally changed the thermostat on the identical time since these two elements got here collectively for $8 from ebay. The dryer might be 40 years previous at this level however working like a champ usually. It simply wants $5-10 price of elements each few years to maintain it glad. And equipment restore is a type of DIY that I can deal with simply (simply don’t ask me to do any critical plumbing!).

Spending for 2025 – 12 months to Date

We spent $29,277 in the course of the first 9 months of 2025. This annual spending is about $700 beneath our budgeted $30,000 for the primary 9 months of the 12 months per our $40,000 annual early retirement price range. I haven’t elevated our annual price range for inflation in a decade, so sooner or later I have to revisit the price range numbers.

After exceeding our price range for many the 12 months, we are actually slightly below our spending goal. With none large surprises, we must always finish the 12 months roughly on price range, plus or minus a pair thousand {dollars}.

Month-to-month Expense Abstract for 2025:

Abstract of annual spending from greater than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $40,286

- 2025 – $29,277 (by 9/30/2025)

Pics from our port go to to Copenhagen, Denmark:

Internet Value: $3,827,000 (+$67,000)

Our web price elevated by one other $67,000 throughout final month to finish September at $3,827,000.

We’re getting ever-closer to the magical $4 million milestone. Nevertheless October hasn’t been treating us kindly thus far, so we’ll see if we are able to hit the $4M mark by 12 months finish. It’ll in all probability be 2026 or later if I needed to guess. However I’m improper fairly usually in the case of inventory market guesses, so we’ll see!

For the curious, our web price reported above consists of our residence worth (which is totally paid off). I worth the home at $300,000, which might be what we might web after gross sales bills. Nevertheless, please word that I don’t take into account my residence worth as a part of my portfolio for “4% rule” calculation functions. I understand of us ask me about that each month so I simply needed to state that right here for readability.

Closing ideas

After a whirlwind of cruises and holidays throughout 2025, we’re lastly slowing down the tempo a bit and spending extra time at residence. We’re right here in Raleigh for 4 weeks straight apart from our fast two day mountain getaway we simply returned residence from.

Throughout this time at residence, I’m working by my to-do record and checking off the bins as a lot as I can. Up to now, so good! We now have another large cruise scheduled throughout November however apart from that, we’ll be at residence for many of the remainder of the 12 months.

This implies we’ll be residence for Thanksgiving and Christmas. Virtually all of our household on my aspect and my spouse’s aspect of the household stay regionally so our household get-togethers are fairly large. We’re internet hosting Thanksgiving this 12 months, so we’ll have to organize a bit for that earlier than our November cruise then sort out the cooking and cleansing and preparations as soon as we get residence from our cruise.

We do have a handful of holidays deliberate in 2026 already however the schedule has us touring at a slower tempo in comparison with 2025. Which is okay with me, as I get pleasure from time at residence, too. Being retired early means it’s at all times trip time irrespective of the place you’re.

Our newest cruise in Europe was incredible, and I’m glad to share Mrs. Root of Good’s pictures with you right here on the weblog. We had so many nice pics that I cut up the pictures in half, and saved all the pictures from the port calls in Estonia, Finland, and Germany for the October month-to-month replace.

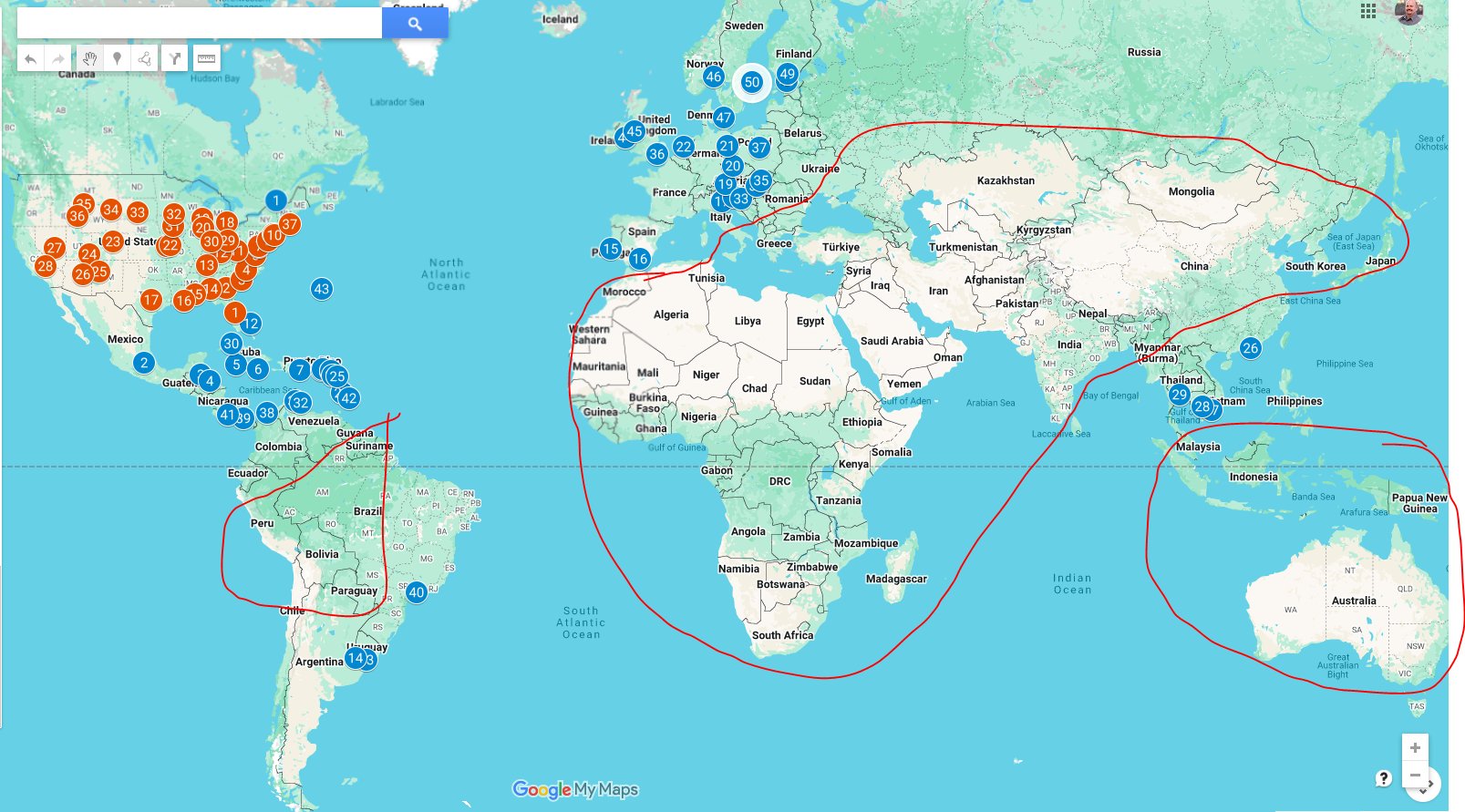

Throughout our final cruise, we visited six nations, 5 of which have been fully new to me. That brings my whole nations visited to 51. As you may see from my “nations visited” map, we’ve barely scratched the floor of visiting in all places on the planet. We nonetheless have a large chunk of South America and Asia to go to, plus the entire continent of Africa and Australia.

Visiting each nation on the planet was by no means my aim. I’m simply grateful to have visited all these superb locations over time. And hope to maintain on hitting the highway for a very long time to return!

Okay, that’s it from me this month. See you subsequent time!

Who’s prepared for Halloween? Thanksgiving? Christmas? It’s arising quickly!

Need to get the newest posts from Root of Good? Make certain to subscribe on Fb, Twitter/X, or by e-mail (within the field on the prime of the web page) or RSS feed reader.

Associated

Root of Good Recommends:

- Private Capital* – It is the very best FREE method to monitor your spending, earnings, and whole funding portfolio multi functional place. Did I point out it is FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus whenever you switch $100,000 to Interactive Brokers zero charge brokerage account. For transfers underneath $100,000 get 1% bonus on no matter you switch

- $750+ bonus with a brand new enterprise bank card from Chase* – We rating $10,000 price of free journey yearly from bank card enroll bonuses. Get your free journey, too.

- Use a buying portal like Ebates* and save extra on every part you purchase on-line. Get a $10 bonus* whenever you enroll now.

- Google Fi* – Use the hyperlink and save $20 on limitless calls and texts for US cell service plus 200+ nations of free worldwide protection. Solely $20 per 30 days plus $10 per GB information.

* Affiliate hyperlinks. In the event you click on on a hyperlink and do enterprise with these corporations, we might earn a small fee.

Uncover extra from Root of Good

Subscribe to get the newest posts despatched to your e-mail.