Welcome again to Root of Good, people! After a really busy 9 weeks of summer season trip in Poland, we’re lastly again house in Raleigh. We capped off our journey in Poland with 9 days in Gdansk close to the Baltic Sea earlier than flying again to the US.

After a summer season of exploring castles and cathedrals, slim alleys in outdated villages, and tree-lined valley trails resulting in waterfalls on the mountainside, it’s nice to lastly be house the place we will loosen up in consolation. We’ve got a full month earlier than we hit the street once more for a two week Alaskan cruise in September.

Proper now, we’re busy with the children’ again to highschool actions. Two youngsters begin faculty the day this put up goes dwell, and the youngest child will begin seventh grade in a couple of week.

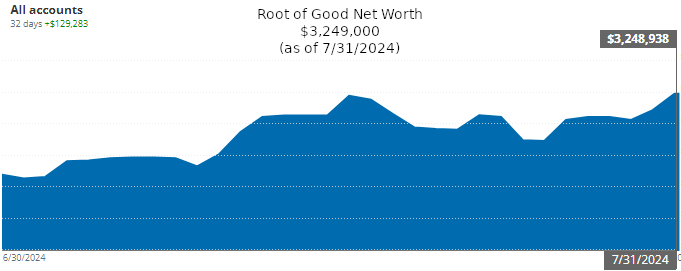

On to our monetary progress. July was a stupendous month for our funds. Our internet value shot up by $129,000 to finish the month at $3,249,000. Our earnings of $10,092 exceeded our spending of $3,735 for the month of July by a large margin.

Let’s leap into the main points from final month.

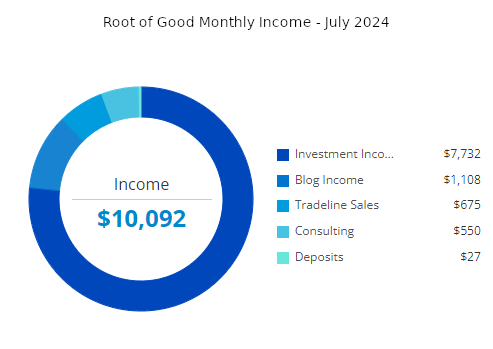

Revenue

Funding earnings totaled $7,732 in July. Our fairness index funds and ETFs pay dividends quarterly on the finish of March, June, September, and December. Consequently, we had a bigger than regular quantity of funding earnings final month for the reason that dividends spilled over from the top of June. Right here’s extra on our dividend investments.

Weblog earnings totaled $1,108 for the month. This represents a barely above common month of weblog earnings.

My early retirement way of life consulting earnings (“consulting”) was $550 final month. That represents three hours of consulting work throughout the month. Summer time all the time appears to be sluggish so perhaps my consulting hours will enhance heading into the autumn. I can’t complain concerning the slowdown although. 9 weeks of trip with hardly any work is nice!

Tradeline gross sales earnings totaled $675 in July. One other nice month. I ramped up my tradeline gross sales a number of years in the past and mentioned it in a bit extra element in my October 2020 month-to-month put up and in my July 2021 month-to-month put up. Most years I make round $4,000 to $6,000 in trade for lending out my stellar credit score historical past from half a dozen bank cards.

For final month, my “deposit earnings” was $27. The deposit earnings got here from money again and incentive bonuses from the Rakuten.com and Mrrebates.com on-line buying portals (a few of which was earned from you readers signing up by means of these hyperlinks).

In the event you join Rakuten by means of this hyperlink and make a qualifying $25 buy by means of Rakuten, you’ll get a $10 join bonus (or extra!).

In the event you’re considering monitoring your earnings and bills like I do, then take a look at Empower Private Dashboard, previously generally known as Private Capital (it’s free!). All of our financial savings and spending accounts (together with checking, cash market, and greater than half a dozen bank cards) are all linked and up to date in actual time by means of Empower Private Dashboard. We’ve got accounts all over, and Empower Private Dashboard makes it very easy to examine on every little thing at one time.

Empower Private Dashboard can be a stable software for funding administration. Retaining observe of our complete funding portfolio takes two clicks. In the event you haven’t signed up for the free Empower Private Dashboard service, test it out at this time (overview right here).

Monitoring spending was one of many crucial steps I took that allowed me to retire at 33. And it’s now simpler than ever with Empower Private Dashboard.

Bills

Now let’s check out July bills:

In complete, we spent $3,735 throughout the month of July which is about $400 greater than our often budgeted $3,333 per thirty days (or $40,000 per 12 months). Journey and utilities have been the 2 largest classes from final month.

Detailed breakdown of spending:

Journey – $3,078:

Our journey spending of $3,078 represents every little thing we spent in Poland for the entire month of July plus a $400 deposit for our October 2024 cruise. The overall only for Poland trip spending was solely $2,678.

I didn’t observe the journey spending in superb element, however I’ve a tough estimate of the place that $2,678 journey spending went:

- $1,000 – a seven evening condominium rental plus 3 nights in inns (2 rooms per evening)

- $550 – rental automotive and gasoline

- $50 – parking

- $28 – Ubers/transit in Wroclaw after we didn’t have a automotive

- $300 – eating places

- $500 – groceries

- $250 – tickets to sights, nationwide parks, museums, and castles

(edit 8/19/2024: a reader requested why we solely had 10 nights of lodging expense. We paid for roughly 80% of our lodging a number of months earlier than our journey began. These 10 nights required cost simply earlier than the stays began, so the funds posted in July)

Most issues are cheaper in Poland than they’re within the USA. Gasoline is about the one factor noticeably dearer due to added taxes.

However on a per-mile foundation, gasoline is barely cheaper in Poland as a result of the rental automotive was far more gas environment friendly than our vehicles in Raleigh. The rental automotive was a hybrid and it was smaller than our personal subcompact automotive in Raleigh. With our gas economic system working round 70 mpg, gasoline was very low cost. Mainly free.

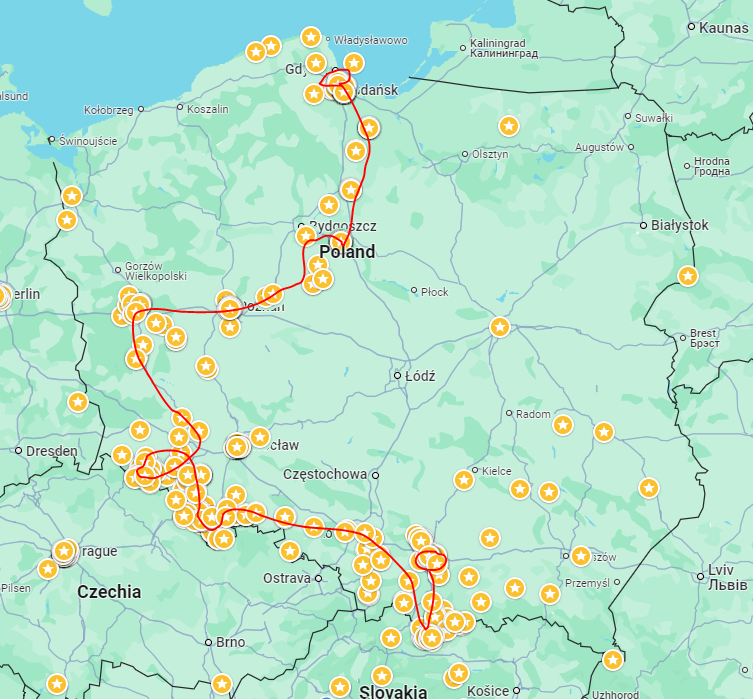

We drove about 2,000 miles round Poland throughout the summer season. From Krakow within the south, west alongside the border with Slovakia and Czech Republic to the western border with Germany after which north and east by means of the central elements of Poland till we ended up in Gdansk (and finally visited the northern coast of Poland and the Baltic Sea). We additionally took quite a lot of day journeys with an hour or two of driving to discover the realm or go to a fort or mountaineering path.

Low cost-ish gasoline and a $18/day rental automotive is a implausible technique to see quite a lot of the countryside with out breaking the financial institution.

Get free journey like us

In case you are considering getting free journey out of your bank card like I do, contemplate the Chase Ink Limitless or Chase Ink Money enterprise playing cards (my referral hyperlink). Proper now, the Chase Ink enterprise playing cards supply an above common $750 to $1000 value of Chase Final Rewards factors that may be redeemed immediately for $750 in money. I simply signed up for one more new Ink card to snag one in all these nice bonus gives.

Chase is fairly liberal on the subject of “what’s a enterprise”. In the event you promote stuff on eBay or Craigslist or do some odd jobs often then you will have a enterprise and will get a bank card as a “sole proprietor”.

I exploit the 75,000 Chase Final Rewards factors by transferring them to my Chase Sapphire Reserve card (additionally providing a 60,000 level join bonus proper now). With the Sapphire Reserve card, I can get 1.5x the factors worth by reserving cruises, flights, inns, or rental vehicles by means of their journey portal. Or 1.25x worth by reimbursing myself for groceries. That turns the 75,000 factors into $1,125 of free journey or $937.50 of free groceries. For instance, I used 165,000 Chase Final Reward factors to pay for the $2,475 in taxes, charges, and gratuities on two of my fall cruises. Or I can switch these Final rewards factors to over a dozen journey companions’ airline/resort applications like United, Southwest, or Hyatt.

Capital One VentureX card

One other favourite journey card in my pockets is the Capital One Enterprise X card. The Enterprise X card is a “keeper” for me. First off, it comes with a $750 join bonus after spending $4,000 within the first three months. The bonus is paid within the type of 75,000 bonus factors that you could redeem in opposition to any journey purchases from anyplace. Then you definately earn a stable 2 factors per greenback spent eternally! The opposite large perk is airport lounge entry. You may get your self plus limitless company into Precedence Go lounges. And also you plus two company can get into Plaza Premium community lounges and Capital One Lounges.

The Capital One Enterprise X card does have one catch – a $395 annual price. However they reward you yearly with a simple to make use of $300 journey low cost plus $100 value of factors. Collectively, that makes $400 they provide you yearly which fully offsets the annual price. One other profit value mentioning: you’ll be able to add as much as 4 licensed customers totally free, and so they additionally get all the advantages of the Enterprise X card together with the precious airport lounge entry. We used this perk to “reward” a pair of Enterprise X playing cards with airport lounge entry to my brother in regulation and his spouse to make use of on their household journey again house to Cambodia final April with their two younger youngsters.

Because the annual price is offset in full by journey credit annually, I personally plan on holding the Enterprise X card eternally for the reason that card advantages are so nice.

Utilities – $427:

We spent $33 on our water/sewer/trash invoice final month. The water consumption is far decrease when there is just one particular person at house. I additionally paid part of the invoice throughout June so the water invoice is even decrease than it usually can be throughout the summer season months.

The pure gasoline invoice was $18.

The electrical energy invoice was $376 for July and August. I paid for 2 months throughout July. These are the height utilization months the place the AC runs rather a lot, and future payments will likely be decrease all through the cooler elements of the 12 months.

Groceries – $169:

Our oldest daughter stayed in Raleigh this summer season and we cowl her grocery payments, so this $169 is what she spent throughout July.

I embody our abroad grocery spending within the “Journey” class of bills. We aren’t as cautious about looking for gross sales and getting offers whereas we’re shopping for groceries abroad. And we attempt quite a lot of new issues. So I lump the groceries whereas touring into our general journey funds.

Healthcare/Medical/Dental – $37:

Our present 2024 medical insurance is free, because of very beneficiant Reasonably priced Care Act subsidies that we obtain attributable to our low ~$48,000 per 12 months Adjusted Gross Revenue.

Our 2024 dental insurance coverage plan prices $37 in premiums per thirty days. We picked a plan from Truassure by means of the healthcare.gov trade. The dental insurance coverage does a superb job of masking routine cleanings, exams, and x-rays plus most of the price of primary procedures like fillings.

Cable/Satellite tv for pc/Web – $25:

We pay $25 per thirty days for an area lowered fee package deal attributable to having a decrease earnings and having youngsters. 50 mbit/s obtain, 10 mbit/s add.

Gasoline – $0:

No regular gasoline spending for the month of July. I embody gasoline for our Poland rental automotive within the “journey” funds class.

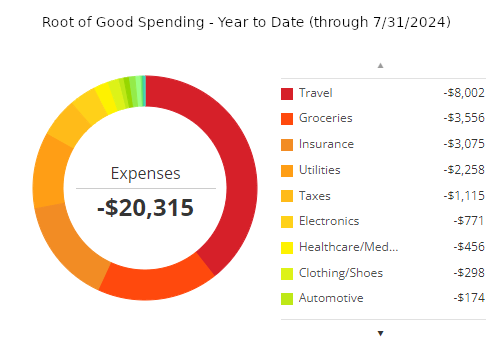

Spending for 2024 – 12 months to Date

We spent $20,315 for the primary seven months of 2024. This annual spending is about $3,000 lower than the budgeted $23,333 for six months per our $40,000 annual early retirement funds. I haven’t elevated our annual funds for inflation in a decade, so in some unspecified time in the future I must revisit the funds numbers. Up to now, so good! No want to present ourselves a elevate if we’re managing simply superb throughout the present funds.

As I discussed in April, our youngsters’ faculty prices are fully paid for by their monetary support to date. So faculty spending ought to stay quite modest all through the remainder of 2024 into 2025. And it seems that each of our older youngsters are on observe to complete their bachelors levels in 2025

The wildcard spending for 2024 will likely be some upcoming dental work for Mrs. Root of Good. We nonetheless don’t know what this can appear to be however we’ll discover out extra within the fall as soon as we return house from our summer season journey. No less than we’re working $3,000 under our funds, so any giant dental bills gained’t make our complete annual spending fully out of line for the 12 months.

We’ve got about six weeks of cruises developing throughout September, October, and November. They’re all paid for and all flights and pre-cruise inns are booked. So trip bills must be modest for the remainder of 2024, except we begin reserving elements of our large summer season 2025 journey. We’ve got no clue the place we’re headed in 2025 so we’ve to determine that out first!

Month-to-month Expense Abstract for 2024:

Abstract of annual spending from greater than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $20,315 (by means of 7/31/2024)

Internet Value: $3,249,000 (+$129,000)

Our internet value shot up by $129,000 to finish the month at $3,249,000. That’s a brand new all time excessive!

We’re not too removed from watching our internet value triple since retiring early nearly 11 years in the past. Who would have thought that doable after we stop working?!

For the curious, our internet value reported above contains our house worth (which is totally paid off). I worth the home at $300,000, which might be what we might internet after gross sales bills. Nevertheless, please word that I don’t contemplate my house worth as a part of my portfolio for “4% rule” calculation functions. I understand people ask me about that each month so I simply wished to state that right here for readability.

Life replace

One other grand summer season journey is within the books. We’re again house and settling in to our routine in Raleigh. The youngsters are again at school, the climate is beginning to cool off, and every little thing is returning to regular.

Although I get a ton of enjoyment and enrichment from our travels abroad, it’s all the time nice to get again house. Our home in Raleigh is so snug and has every little thing we would like.

I jokingly confer with vacationing in Europe as “tenting” as a result of we frequently miss the creature comforts we take pleasure in at house similar to air-con, window screens, bathe curtains, garments dryers, and enormous correctly functioning fridges. I’m okay with “roughing it” to a sure extent whereas touring as a result of I take pleasure in seeing all of the locations we go to. Creature consolation generally has to come back second to “exploring off the crushed path”.

A interval away from house the place it’s important to address the occasional little bit of adversity serves to spotlight simply how good you will have it at house. I feel we develop accustomed to all of the niceties in our lives and neglect simply how good we’ve it till these good issues are quickly taken away.

So we noticed quite a lot of cool issues in Poland and in addition acquired a reminder of simply how lucky we’re to have the facilities we take pleasure in at our house in Raleigh.

Nicely people, that’s it for me this month. See you subsequent month!

What do you consider the pics from Poland? A spot you would possibly need to go to? Or give it a cross?

Need to get the most recent posts from Root of Good? Be sure to subscribe on Fb, Twitter, or by e mail (within the field on the high of the web page) or RSS feed reader.

Associated

Root of Good Recommends:

- Private Capital* – It is the very best FREE technique to observe your spending, earnings, and whole funding portfolio multi functional place. Did I point out it is FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus while you switch $100,000 to Interactive Brokers zero price brokerage account. For transfers below $100,000 get 1% bonus on no matter you switch

- $750+ bonus with a brand new enterprise bank card from Chase* – We rating $10,000 value of free journey yearly from bank card join bonuses. Get your free journey, too.

- Use a buying portal like Ebates* and save extra on every little thing you purchase on-line. Get a $10 bonus* while you join now.

- Google Fi* – Use the hyperlink and save $20 on limitless calls and texts for US cell service plus 200+ international locations of free worldwide protection. Solely $20 per thirty days plus $10 per GB knowledge.

* Affiliate hyperlinks. In the event you click on on a hyperlink and do enterprise with these firms, we could earn a small fee.