I like beautifully-designed software program.

I like highly effective/versatile monetary software program.

It’s been some time since I’ve discovered an software that’s each, however that’s precisely what I’ve for you as we speak…

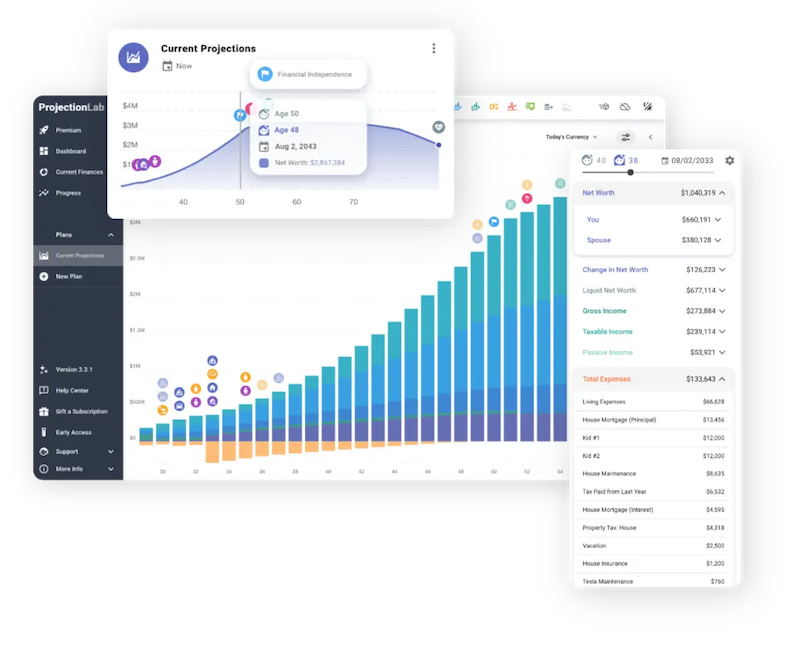

ProjectionLab is essentially the most stunning monetary planning instrument I’ve ever seen.

And, it was created particularly for folks pursuing FIRE, so it’s additionally the most-useful planning instrument I’ve discovered for FI!

The indie developer who constructed it’s right here as we speak to inform you all about it.

Take it away, Kyle!

Hey everybody, I’m Kyle.

Once I completed undergrad again in 2015, I by no means thought that simply 8 years later I’d have achieved monetary independence by 30… and I used to be proper! I’ve not 🥲

However I’ve at the least began getting my act collectively. Thanks largely to blogs, books, and podcasts like The Mad Fientist, The Easy Path to Wealth, A Random Stroll Down Wall Road, Psychology of Cash, Monetary Freedom, and lots of different favorites.

Throughout my early years in “the true world,” I hardly ever considered cash. Positive, I knew a number of guidelines of thumb – avoid wasting for retirement, don’t spend an exorbitant quantity on hire. However principally, I’d daydream about after I’d have sufficient PTO for one more trip to go scuba diving and make journey movies.

However what accompanied these daydreams was a gnawing feeling that there ought to be extra to life than the basic American sample of working till you’re too previous to get pleasure from it.

Does sacrificing the very best hours of your finest days of your finest years to conferences, briefings, and paperwork actually add as much as your finest life?

Then I found FI neighborhood thought leaders like Pete Adeney, J.L. Collins, Vicki Robin, and The Mad Fientist. Their message hit me like a freight prepare. I knew straight away that I wanted to take extra energetic management of my monetary future. And that if I did, sometime I would finally have the liberty to be my finest self on a regular basis, not just some weeks a yr.

I dove head-first down the FI rabbit gap. I discovered about leanFIRE, fatFIRE, common FIRE, coastFI, Barista FIRE, and every little thing in between.

However one thing was lacking. Principle is good, however I needed to actually see how this was going to work. I needed a hands-on and visible solution to map out all of the choices and discover the trade-offs between completely different life plans. So, I went searching for a long-term planning and forecasting instrument. One thing trendy, fluid, nuanced, and truly enjoyable to make use of.

[ Cut to black.]

So I made a factor

[Camera fades back in. Blur effect. Narrator wakes up in a daze, trying to shake off two years of caffeine-powered nights and weekends.]

After a pair thousand hours of coding, let me introduce ProjectionLab!

I couldn’t discover the proper long-term monetary planning instrument, so I made a decision to construct one 🙃

With ProjectionLab, you’ll be able to create stunning monetary plans with a degree of nuance and suppleness that exceeds the usual on-line retirement calculators. You possibly can run Monte Carlo simulations, backtest on historic information, evaluation detailed analytics for estimated taxes, and plan the right way to dwell life in your phrases. And with some luck, cut back anxiousness round your funds.

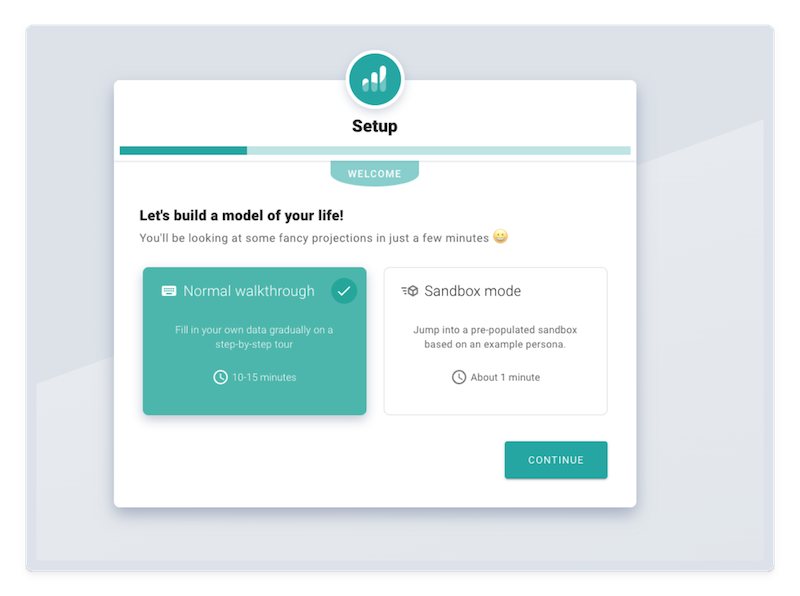

There’s a free sandbox, if you happen to simply need to hop in and see the way it works. It doesn’t ask to hyperlink your monetary accounts. You don’t need to create an account to attempt it, and it really works fairly nicely for worldwide eventualities.

It respects your information and won’t attempt to upsell you on advisory companies. It’s only a factor I made that you simply may like 🙂

Okay, however who am I?

I’m a software program engineer from Boston. Initially, I grew up in coastal Maine.

I didn’t count on to at some point change into a “Masshole” as they’re, um, affectionately known as again dwelling 😅… however right here I’m!

And I did flip 30 this yr. Ever since I used to be a child, I’ve at all times had a ardour for making issues. I began coding video video games in center college, and mastered the artwork of dodging options to “go play baseball as a substitute”. Over time, I’ve at all times had a private mission or two on the aspect.

The way in which that coding can allow you to take artistic concepts and manifest them in the true world will at all times really feel a bit like magic to me. And with aspect initiatives, it’s refreshing to be freed from the constraints that regularly make writing enterprise software program a drag. No stand-up conferences, no dash retrospectives, no altering necessities, and no funding to fret about!

ProjectionLab began as considered one of these artistic retailers. And it has grown into much more.

TL;DR. What are you able to do with this?

Here’s a fast abstract:

– Construct nuanced fashions of your complete life

– Plan individually or as a pair

– Outline what phrases like monetary independence imply to you

– Mannequin advanced choices primarily based on objectives like reaching FI, taking day without work for journey, dwelling possession, or beginning a rental empire

– Create a number of plans and evaluate them

– Visualize projected cash-flow with Sankey diagrams

– Evaluation estimated taxes and efficient tax brackets for every sort of earnings

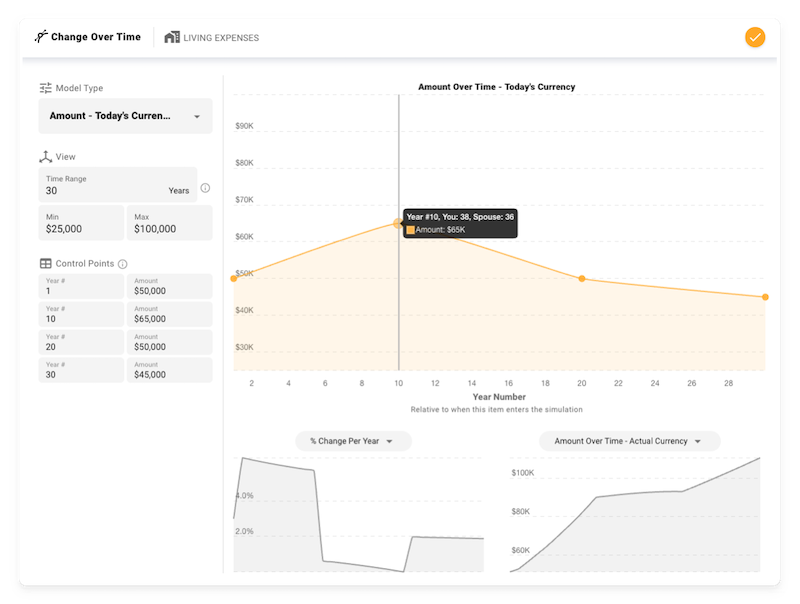

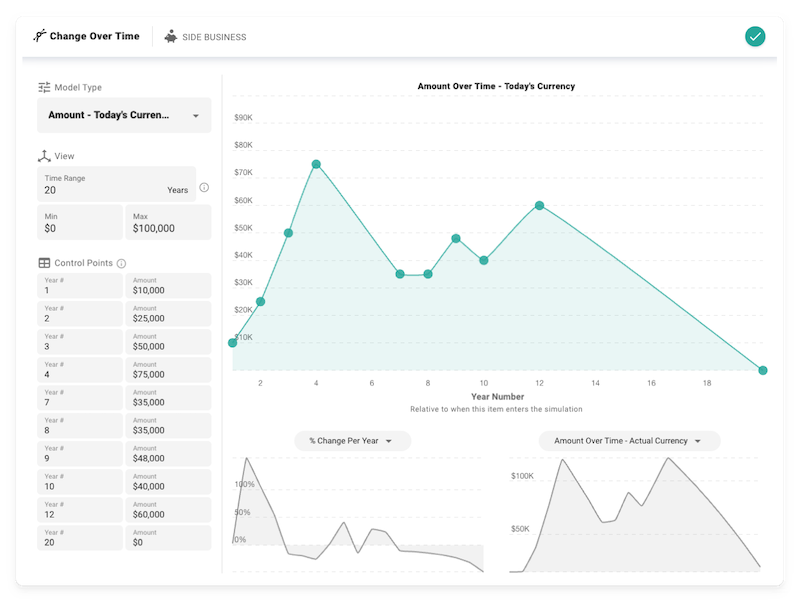

– Apply granular controls for the way you count on accounts/earnings/bills/inflation/and so forth to alter over time

– Experiment with Roth Conversions, 72t (SEPP) Distributions, and different superior methods

– Mannequin worldwide eventualities

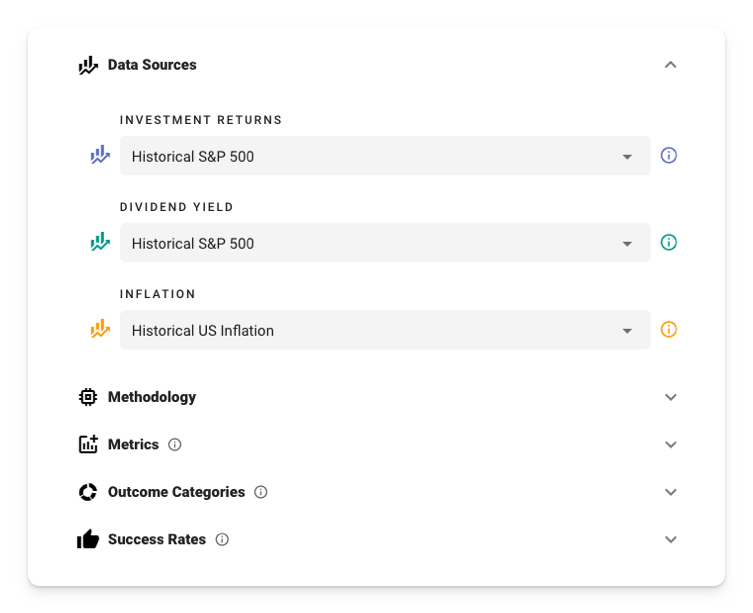

– Backtest on historic information and run Monte Carlo simulations to research the spectrum of doable outcomes

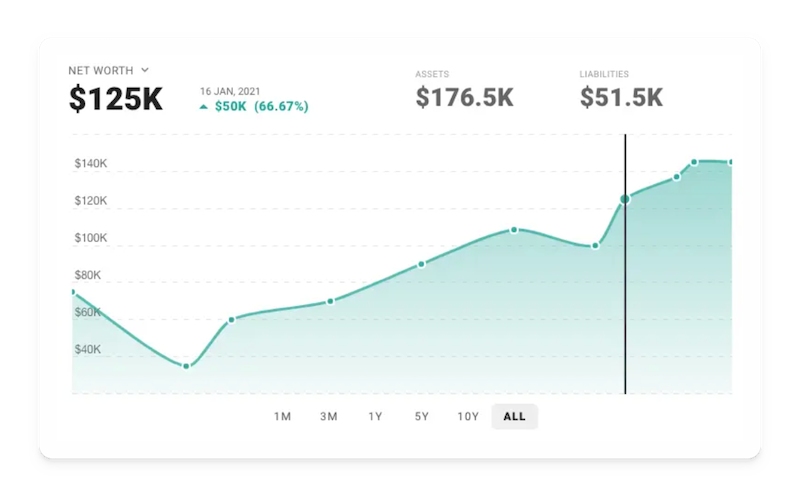

– Observe your precise progress over time

– Management the place your information is saved, with no hyperlink to your actual monetary accounts

What does FI imply to you?

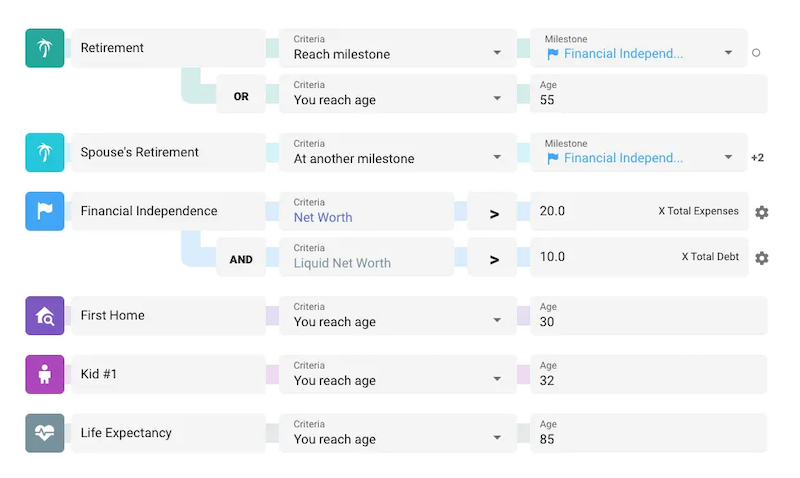

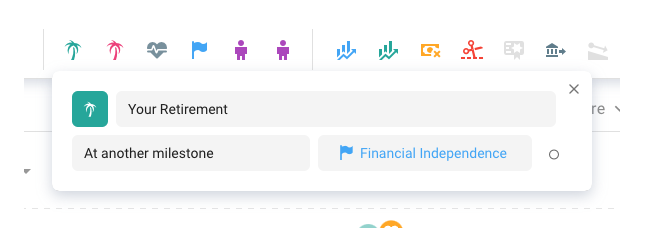

Take into consideration the longer term you hope for. What are a number of the milestones alongside the way in which? One of many first contact factors if you create a plan in ProjectionLab is the milestone system. It helps to seize the big-picture objectives you care about. And because you’re studying The Mad Fientist, likelihood is that monetary independence is considered one of them.

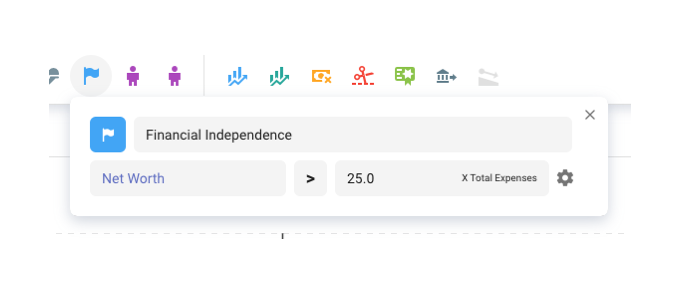

However what does FI imply if you break it down? Individuals have completely different definitions, and I needed the milestone system to accommodate that. As an illustration, do you solely contemplate your self FI at a particular a number of of bills and a sure liquidity-to-debt ratio? No drawback: you’ll be able to create a milestone with extra standards.

I’ve put some thought into making milestones versatile and customizable. They are often something from retirement or buying a house, to reaching your private definition of economic independence, having youngsters, shifting to a brand new state or nation, switching careers, going part-time, and so forth. They will even have tax penalties.

And most significantly: you need to use them as a framework to assist scaffold the remainder of your plan and management when varied occasions ought to begin and finish (earnings streams, bills, asset purchases, and so forth.)

Okay. No matter. Is that simply advertising converse, or is that this truly helpful? How about we construct a state of affairs collectively and discover out!

Let’s construct a plan collectively

Right this moment, we’ll be an early-career married couple with pupil loans, at present renting, eager to have youngsters sometime, and we simply came upon about this factor known as “monetary independence.”

Let’s see if we will get a way for the place we at present stand, the place we’re headed, and the right way to plan a life we’ll love.

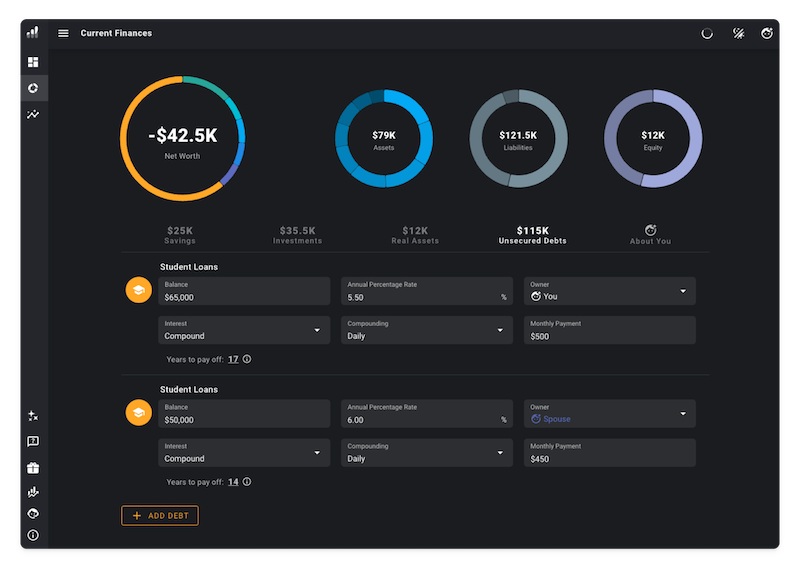

As soon as we cruise by the setup wizard, right here is how issues are wanting throughout the Present Funds part. I may also take the freedom to level out that there’s a darkish mode, if you happen to’re into that 😎

Our present web value is damaging, as a result of pupil loans, however we’re going to get issues shifting in the suitable course quickly.

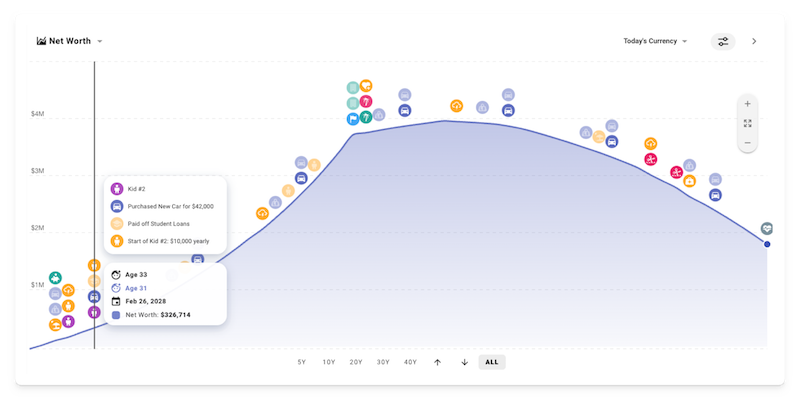

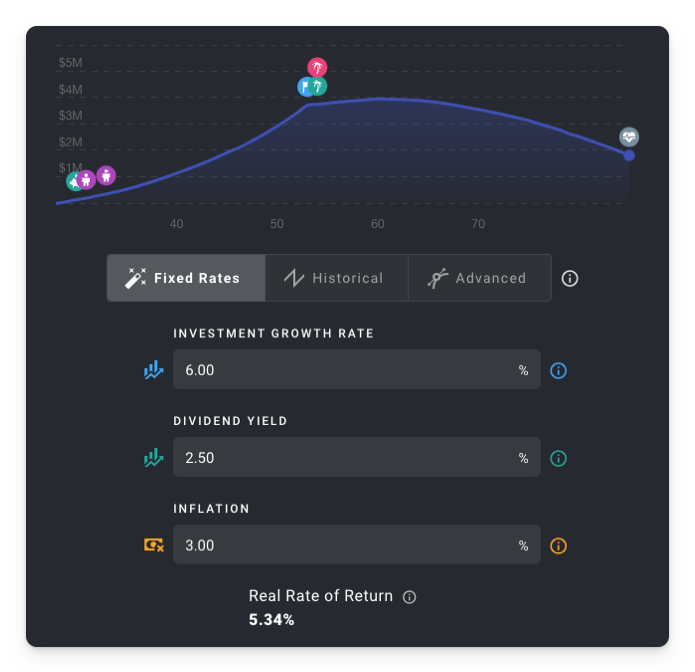

To make projections for the longer term, let’s create a plan and outline development charge and inflation assumptions for the deterministic planning mode. We’ll add milestones, earnings streams, bills, and cash-flow priorities, select our tax configuration, set a portfolio-level inventory/bond allocation over time, and outline a drawdown sequence.

Within the curiosity of time, let’s gloss over that setup course of.

The baseline state of affairs

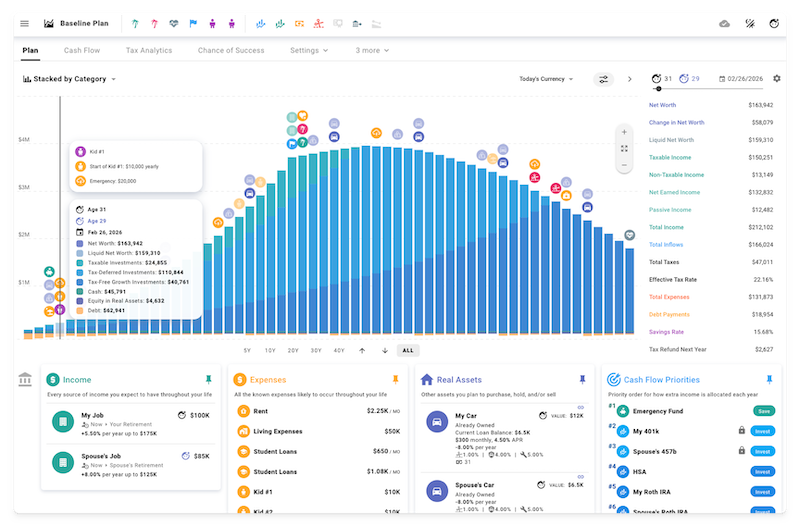

To maintain issues approachable, that is what a fundamental model of our plan may appear like.

It contains two youngsters, simple profession development, contributions to some employer-sponsored retirement accounts, shopping for a automobile each 8 years, medical bills rising later in life, and a few sudden emergencies occurring each 15 years (and scaling up a bit every time).

On this case, we are going to outline Monetary Independence as a milestone that happens when web value reaches 25 instances bills.

And we are going to configure retirement to happen as soon as we attain it.

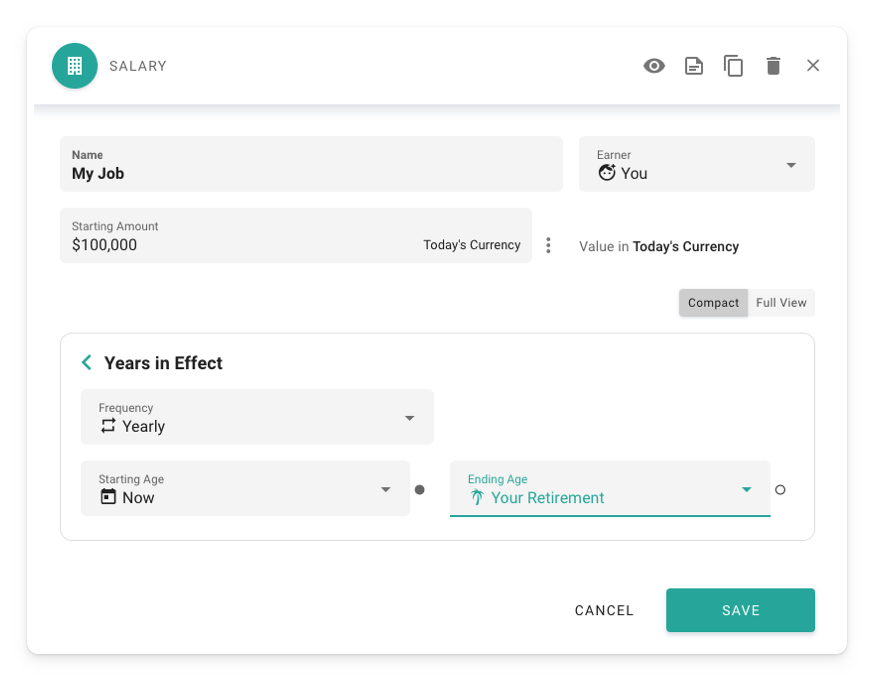

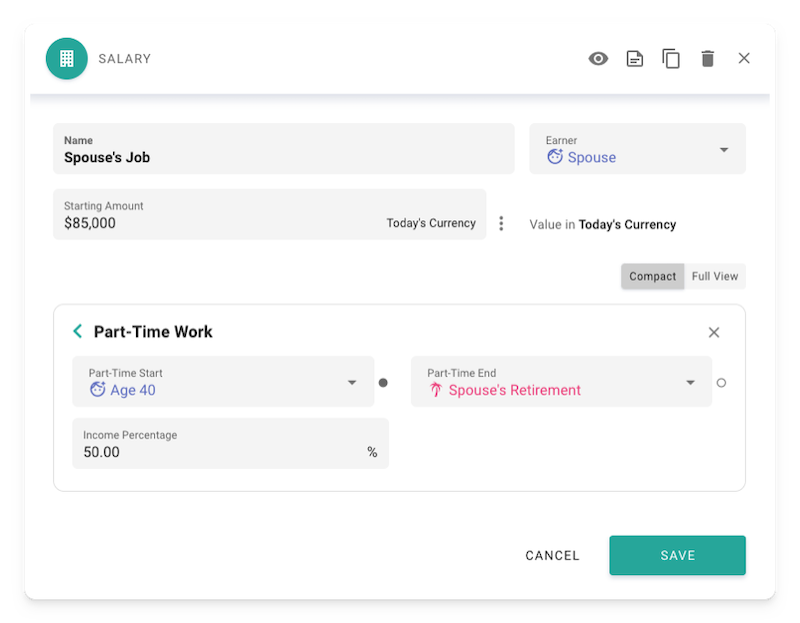

Then, we will use these milestones as bindings once we create different occasions. As an illustration, here’s a W2 earnings stream configured to finish on the retirement milestone.

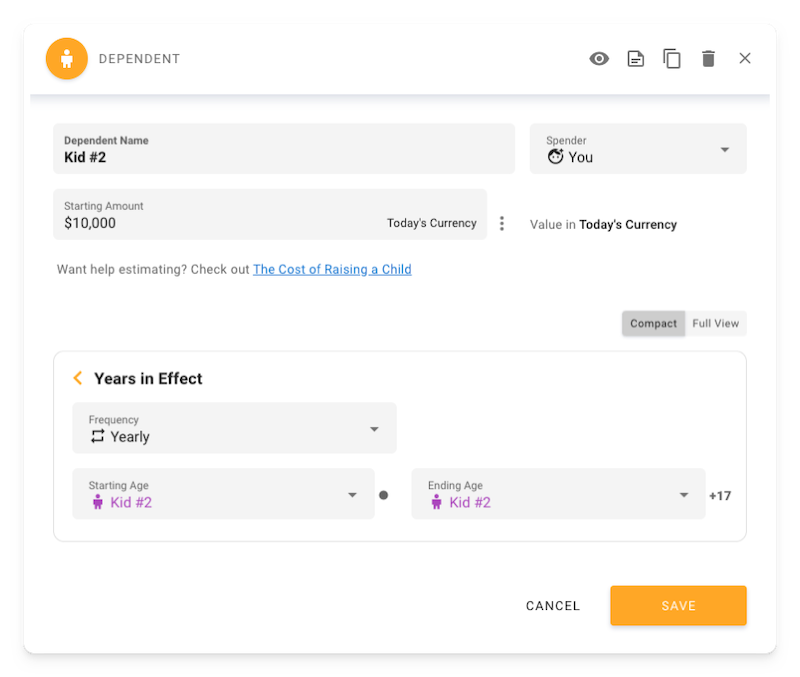

We will additionally add milestones for the youngsters, and bind bills to these. This manner, any tweaks we make later to our milestones will propagate to every little thing else within the plan routinely.

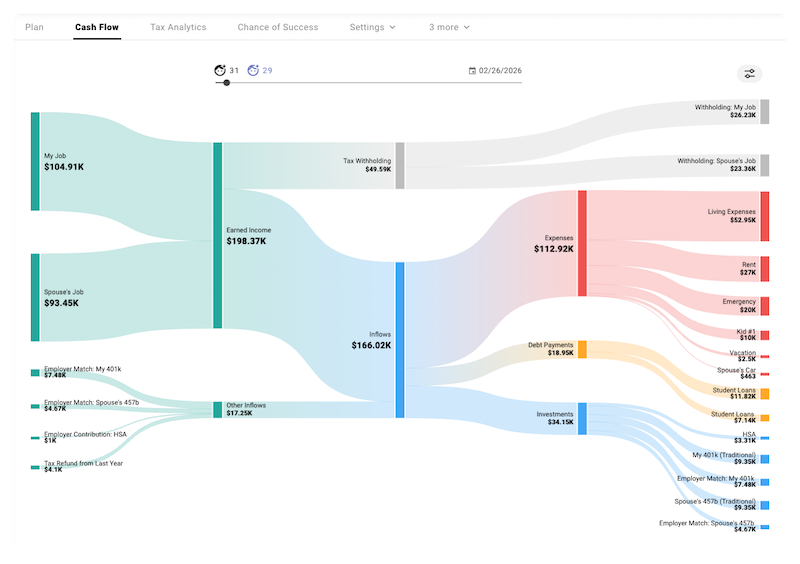

Money circulation visualization

So, what precisely is occurring in considered one of these simulated years? The sankey chart within the money circulation tab may help with that.

We will see how earned earnings (much less withholding) flows into the plan, together with employer match/contributions to tax-advantaged accounts, and the way these inflows are used to pay for bills, service debt, contribute in the direction of investments, and/or construct an emergency fund primarily based on our money circulation priorities.

Tax analytics

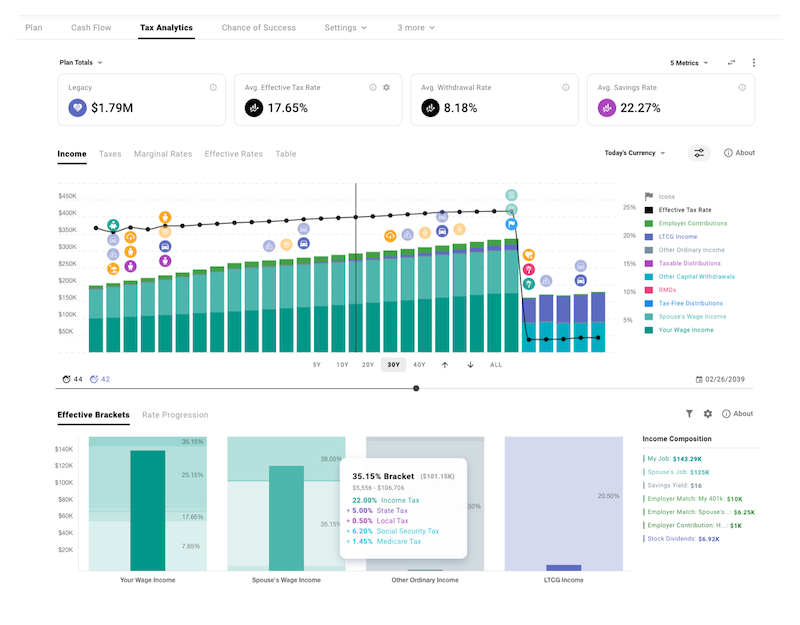

We will additionally use the tax analytics module to drill down on particular years and study how the assorted sorts of estimated taxes and their underlying brackets apply to every earnings kind.

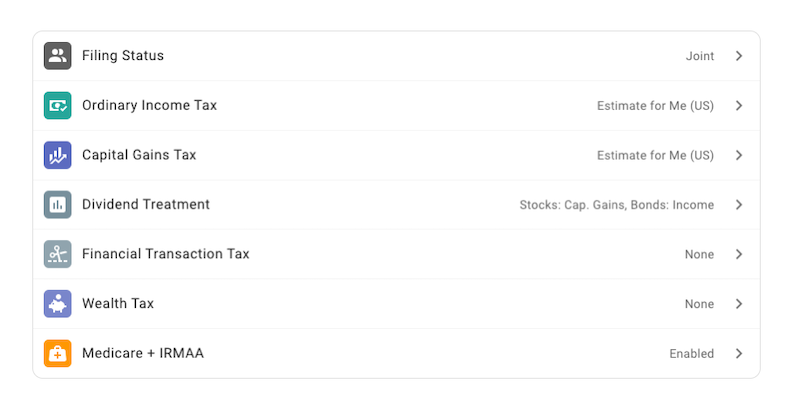

Inside our plan’s tax settings, we’ve enabled US tax estimation:

And right here’s a take a look at our projected future earnings and the efficient tax brackets that apply to every kind.

You possibly can plot marginal and efficient tax charges over time, and likewise see how additional hypothetical {dollars} of every type can be taxed.

Monte Carlo simulation

However can we count on the market to supply a constant return yearly? Nope. And our plan shouldn’t both.

Thus far, now we have simply been enjoying round in deterministic mode and assuming a constant 5.34% actual charge of return.

We might select to discover a particular historic sequence, or create customized return/inflation curves to mannequin a state of affairs of our personal design.

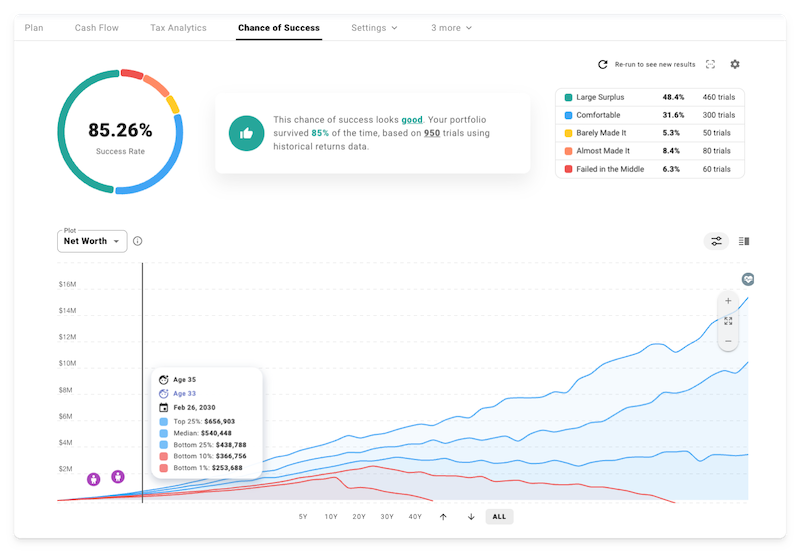

However what if we actually need to get a greater sense for the total spectrum of doable outcomes? Time to go to the Probability of Success tab and run some Monte Carlo simulations!

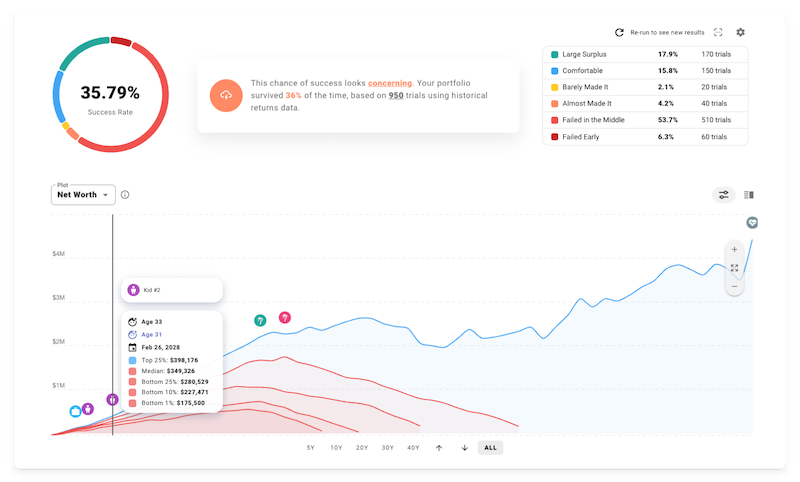

Based mostly on 950 trials utilizing historic S&P 500 returns, dividends, and US inflation information, right here’s how issues are wanting to this point:

Fairly stable probability of success! And plenty of potential outcomes that really exceed our future wants by a big margin.

However, is the life we’ve modeled up thus far actually the one we would like?

Reaching FI in our early to mid 50s after almost three a long time of full-time work is a good accomplishment. However is there any approach we might purchase our freedom even earlier?

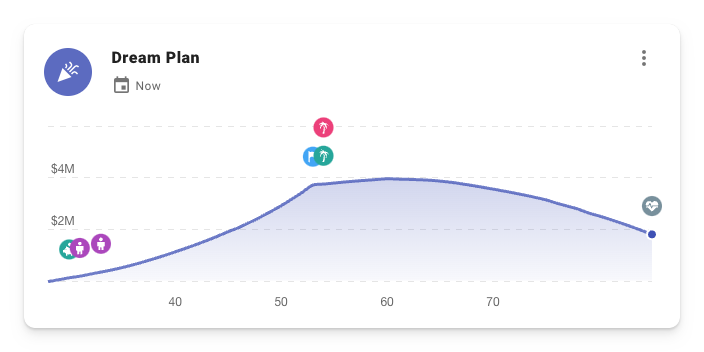

The dream plan

Let’s create a second plan and discover some methods to get artistic. We’ll begin by cloning and renaming the unique.

Final time, we allowed some way of life inflation to drive up our annual spending over time. Right here, let’s preserve that below management and construct a extra granular mannequin for the way we predict our important dwelling bills could evolve.

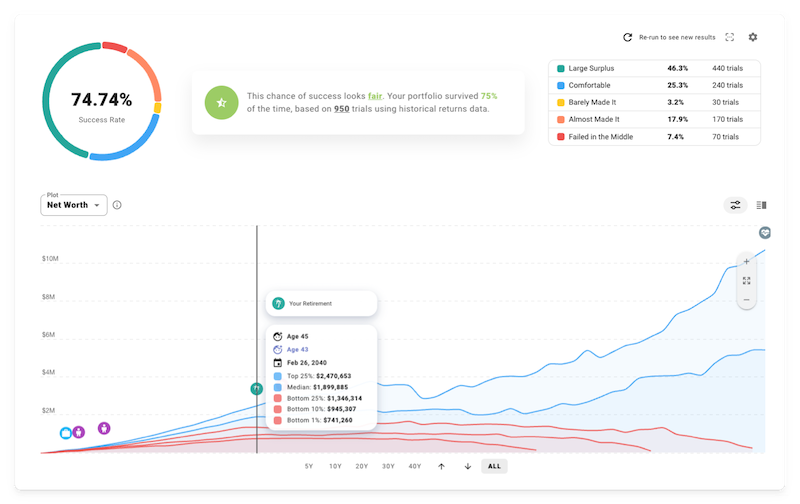

We may also cease renting and purchase a home for $500k across the time Child #1 is born. Then, we’ll drop all the way down to 50% part-time work at age 40, and we’ll each try to totally retire from our W2 jobs at a hard and fast age of 45.

What does all that do to our probability of success? Okay, so model 1 of the Dream Plan isn’t wanting nice.

Hmmm.. however what if considered one of us works laborious over the subsequent couple years to land a job paying 25% extra, and we keep away from inflating our bills to match?

That brings us nearer to a 50% success charge.

And what in regards to the additional time we’ll have throughout part-time work after which early retirement? Possibly now we have some hobbies or ardour initiatives now we have at all times needed to attempt to develop right into a aspect enterprise?

Let’s mannequin one which begins producing some income throughout that interval of part-time work.

That additional earnings smooths out these early years after retirement, and brings the success charge again to a extra cheap degree close to 75%.

Need to be taught extra?

At this level, now we have simply scratched the floor of what you’ll be able to mannequin in ProjectionLab.

For those who really feel like taking it for a spin, you could need to dig additional under consideration sorts and liquidity settings, inventory/bond allocation over time, worldwide templates and tax config, patterns of asset purchases + gross sales, drawdown order, rental properties, progress monitoring… Okay, I’ll cease now 😛

Listed here are a number of hyperlinks with extra data:

You possibly can run fundamental simulations without spending a dime with the sandbox model, and you need to use this coupon code for 10% off the premium model: MADFIENTIST-10 🎉

Thanks lots for sharing, Kyle!

Since I feel that is the most-useful (and exquisite) FI planning instrument out there, I added a everlasting hyperlink to the sidebar of the FI Laboratory, so as to simply run projections if you’re updating your FI numbers.

Head over to ProjectionLab now, run a number of simulations, and see if you happen to’re as impressed by the software program as I’m!